Insurance Appraisal Services

COMPROMISE NOTHING – DOCUMENT EVERYTHING

The Claims Appraisal process is not a trial run, nor a preliminary negotiation.

It is usually the end of the road. Those who enter it must do so with seriousness and the understanding that the outcome will likely be final, and enforceable.

Appraisal - ADR (Alternative Dispute Resolution)

Most insurance policies contain a provision stipulating that either the insurance company or the insured has the right to demand or invoke “Appraisal”, if said party disagrees as to the amount of the insured loss. The Appraisal Process (ADR) is NOT about policy coverage.

Appraisal is about How, & How Much. -

It is important to understand this. For example: If your property was damaged from a covered loss; insurance paid that loss but did not provide enough money to handle all repairs owed. Or if the scope of repairs is not understood & is underpaid.

The Appraisal may be the right direction in these examples.

There are some things to look out for… I have listed a couple here:

If the insurance carrier denied the damages suffered (for example) to your roof, going straight to appraisal would not be the right decision at that time, because the “covered damages” has not been agreed to. To resolve coverage issues, it is often best to hire us as your Public Adjuster.

If coverage has been extended but the dollar amount provided is not accurate, then Appraisal may be the right course of action.

The Appraisal provision will likely read something like this:

“If we and you disagree on the amount we owe, either party may make a written demand for appraisal of the covered loss. Each party will select a competent and impartial appraiser and notify the other within 20 days of the demand”.

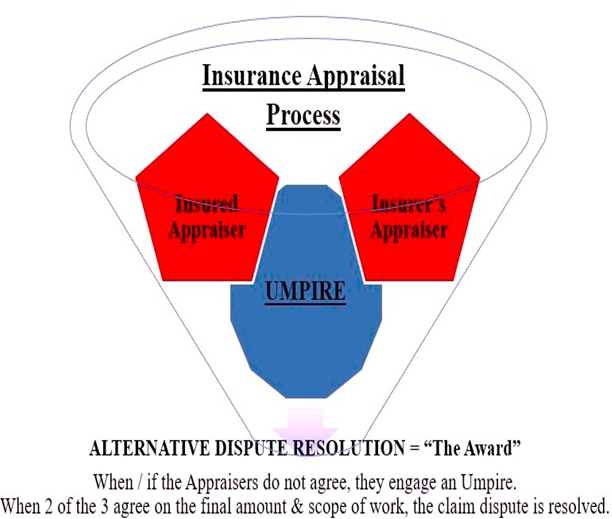

The purpose of the Insurance Claim Appraisal process, or Alternative Dispute Resolution as it is known, is to offer both parties, the insured and the insurance company, a more expedient alternative to going to court to settle.

Appraisal has many similarities to binding Arbitration, but the two processes are not identical.

The Appraisal process is made up of (in essence) 3 participants:

The Insured’s (your) Appraiser * Insurer’s Appraiser and the Appraisal Umpire.

The insurance company and the insured both select their own Insurance Claims Appraiser to represent their side in the process, which sounds fancy and complex but this person can be a contractor, an engineer, a Public Adjuster, etc. - a qualified person to represent your side of the claim dispute.

As part of the Appraisal Process, the appraisers (try to) agree on a neutral Umpire; if they cannot agree on an Umpire, the courts may appoint the Umpire for them.

Should the Claims Appraisers not agree on the scope of work/cost of the final amount of the claim, the appointed Umpire will review both appraisers estimates; determine a final ruling known as, "The Appraisal Award".

Our extensive knowledge of the insurance carrier’s claims has proven beneficial in moving clients’ claim disputes forward toward an equitable resolution.

The Appraisal process, when properly utilized, can be an effective means to conclude some insurance claims disputes.

What Are Insurance Appraisals?

The Appraisal Clause (or Appraisal Provision) allows you to seek Alternative methods for reaching a claim's pay-out decision aka, Alternative Dispute Resolution.

Contact us to help – we compromise nothing - uphold commitments.

Claim Denied, Unfiled, or Underpaid? We Can Help

If your insurance company has underpaid on a settlement or denied you coverage, we are here to help. At Allen Claims, Inc. we document, estimate, and negotiate the claim on your behalf.

Please reach out for anyway we may serve you.

Fill out a form today to get the compensation you deserve.

Share On: